Skip the tax stress.

CGT filed for £299

Sold a UK property? We’ll handle your Capital Gains Tax submission from start to finish. No guesswork, no missed deadlines.

.jpg)

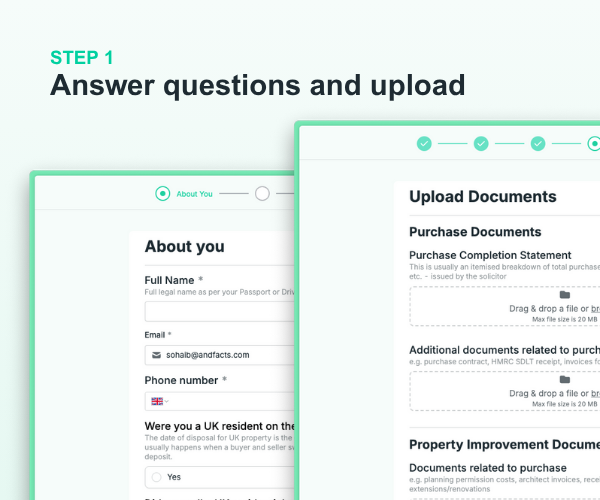

We make your CGT submission fast, simple, and stress-free

Everything you need to file fast

Fixed Fee

No hourly rates — just £299 for a solo submission, or £449 for joint.

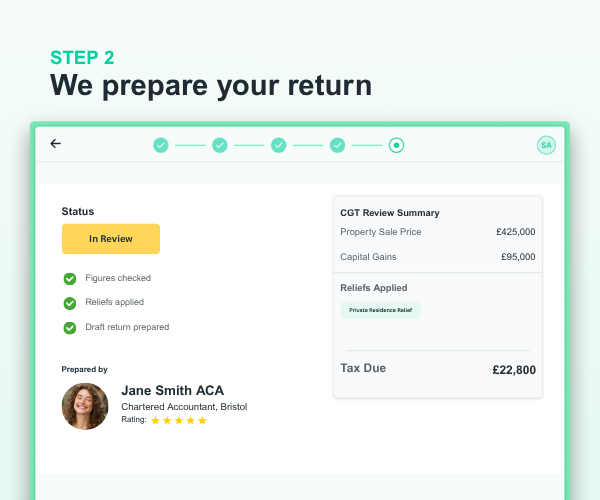

Chartered Accountants

Handled entirely by UK-based chartered accountants, not software.

Fast Turnaround

We prepare and file your CGT return in 3 working days.

Full Review

We ensure every relief and allowable cost is properly applied.

Secure Upload

Easily upload your documents via our secure online portal.

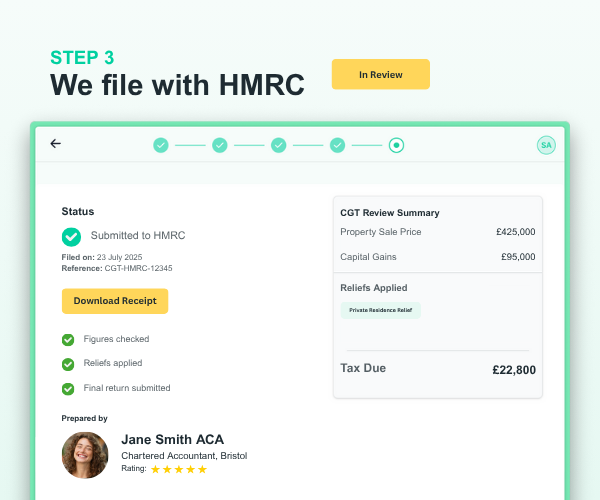

Submission Record

Get a full submission confirmation for your own records.

Stop wrestling with CGT.

It’s simpler and cheaper than you think

HMRC’s 60-day portal is loaded with jargon, manual calculations and guesswork, while hire-by-the-hour accountants add cost and delay. There’s a faster, fixed-fee way to get it done.

CGT filing shouldn’t be this hard

Filing Capital Gains Tax yourself means decoding relief rules, calculating gains, and navigating HMRC’s system alone. Traditional accountants drag it out — and charge you for every step. You don’t need that headache.

We make your CGT submission fast, simple, and stress-free

Our online service is built to remove all the friction. No forms. No waiting. No confusion. Just upload your documents and we’ll file your return — accurately and on time.

Built for every kind of UK property seller

Whether it’s your home, a second flat, inherited property, investment or a rental —

we’ll handle the CGT return so you don’t have to.

Main home

We apply private residence relief and calculate what’s owed.

Additional homes

We handle CGT exemptions and save you time.

Rental or investments

We apply letting relief and allowable costs accurately.

Trusted & Compliant

Certified, regulated, and authorised to handle your tax returns.

HMRC Authorised

Authorised by HMRC to file returns on your behalf.

CIMA Certified

Handled by qualified Chartered Accountants in the UK.

GDPR Compliant

Your data is protected, and securely handled at all times.

Xero Partner

Integrated with Xero for seamless tax preparation

Frequently Asked Questions

Got questions? We’ve answered the most common ones about our services, packages, and how everything works.

Who needs to file a CGT return when they sell a UK home?

Anyone who sells UK residential property at a gain and does not get 100 % Private Residence Relief must file a CGT return, even if the tax due is £0. Exemptions normally apply only when the property has been your sole/main home for the entire ownership period.

How much does Sorted cost?

One flat fee: £299. That covers expert review, CGT calculation and HMRC electronic submission—no hidden extras.

How fast will my return be filed?

Upload your details and documents online; a UK-chartered accountant reviews them and files within 3 working days once we have received your approval.

What information or documents do I need to provide?

Sale and purchase contracts (or completion statements), dates, purchase and selling prices, allowable improvement costs, letting periods, and any valuations. Swiftcgt’s onboarding form flags the exact items and lets you drag-and-drop PDFs or photos.

Can I use your service if the property was owned jointly?

Yes. Each owner needs their own CGT return, but we prepare linked filings and apply reliefs correctly. We provide a 50% discount on the return for additional owners for the same property: £449 for 2 owners (£149 saving), £599 for 3 owners (£299 saving)

Do I still need to complete Self Assessment?

Only if you have other gains or income that put you in Self Assessment. A standalone CGT return via Sorted Tax satisfies the property requirement.

Do I pay CGT on my main residence?

Usually not. Private Residence Relief eliminates CGT if the property has been your only or main home for the whole ownership period and certain conditions are met. Partial relief may still reduce the gain if you lived there only part-time.

No stress. No surprises.

Just £299.

We’ll handle your tax return from start to finish — and if you’re not satisfied, you get your money back.

.png)